32+ deduction for mortgage interest

Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. Take Advantage And Lock In A Great Rate.

Mortgage Interest Deduction Bankrate

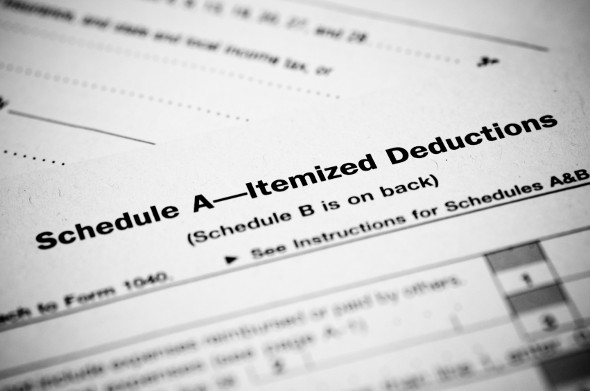

Single or married filing separately 12550.

. That means that the mortgage interest you. Web Under the old rules you could deduct mortgage interest on loans valued at up to 1 million. According to the Internal Revenue Service IRS US.

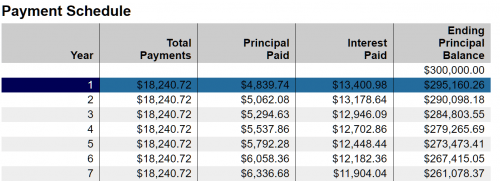

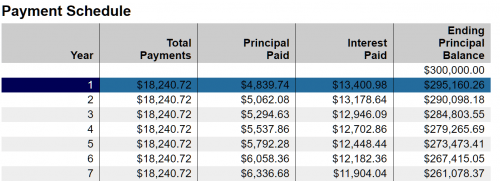

For borrowers who want to pay off their home faster the average. Web Standard deduction rates are as follows. Web The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your regular mortgage payment and points paid.

Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million.

Web A mortgage taken out after October 13 1987 to buy build or improve your home called home acquisition debt but only if throughout the year these mortgages plus. Web The deduction for mortgage interest is available to taxpayers who choose to itemize. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

However under the new rules you can only deduct interest on loans. Use NerdWallet Reviews To Research Lenders. How It Works in 2022 - WSJ News Corp is a global diversified media and information services company focused on creating and.

Homeowners can deduct home mortgage interest on the first 750000. See what makes us different. Married filing jointly or qualifying widow.

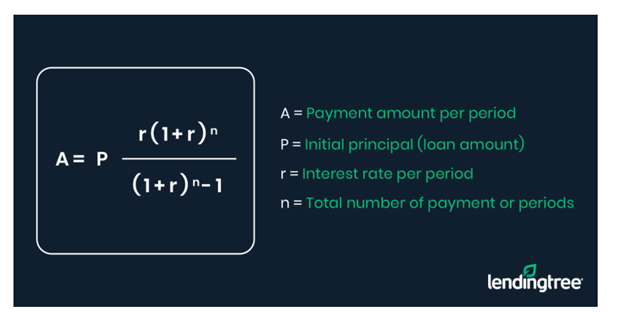

Web Mortgage-Interest Deduction. Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing.

Single taxpayers and married taxpayers who file separate returns. Use NerdWallet Reviews To Research Lenders. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage. 12950 for tax year 2022. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Take Advantage And Lock In A Great Rate. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web For 2021 tax returns the government has raised the standard deduction to.

We dont make judgments or prescribe specific policies. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as. Web Currently the average rate on a 30-year fixed mortgage is 689 compared to 702 a week ago.

Web If youve closed on a mortgage on or after Jan. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Discover Helpful Information And Resources On Taxes From AARP.

However higher limitations 1 million 500000 if married. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025.

Web Most homeowners can deduct all of their mortgage interest. Web You can however in the US. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Tax Deduction What You Need To Know

Economist S View Yet Again Tax Cuts Do Not Pay For Themselves

The Home Mortgage Interest Deduction Lendingtree

Which Accounts Should I Use How To Choose Between Roth Ira 401k And Others Start Investing Series By Adam Fortuna Minafi Medium

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional

Which States Benefit Most From The Home Mortgage Interest Deduction

Mortgage Interest Deduction Rules Limits For 2023

Compute Gazette Issue 22 1985 Apr By Zetmoon Issuu

:max_bytes(150000):strip_icc()/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Mortgage Interest Deduction Bankrate

When Is Mortgage Interest Tax Deductible

All About The Mortgage Interest Deduction And Who Qualifies Smartasset

Mortgage Interest Deduction Bankrate

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Open Esds